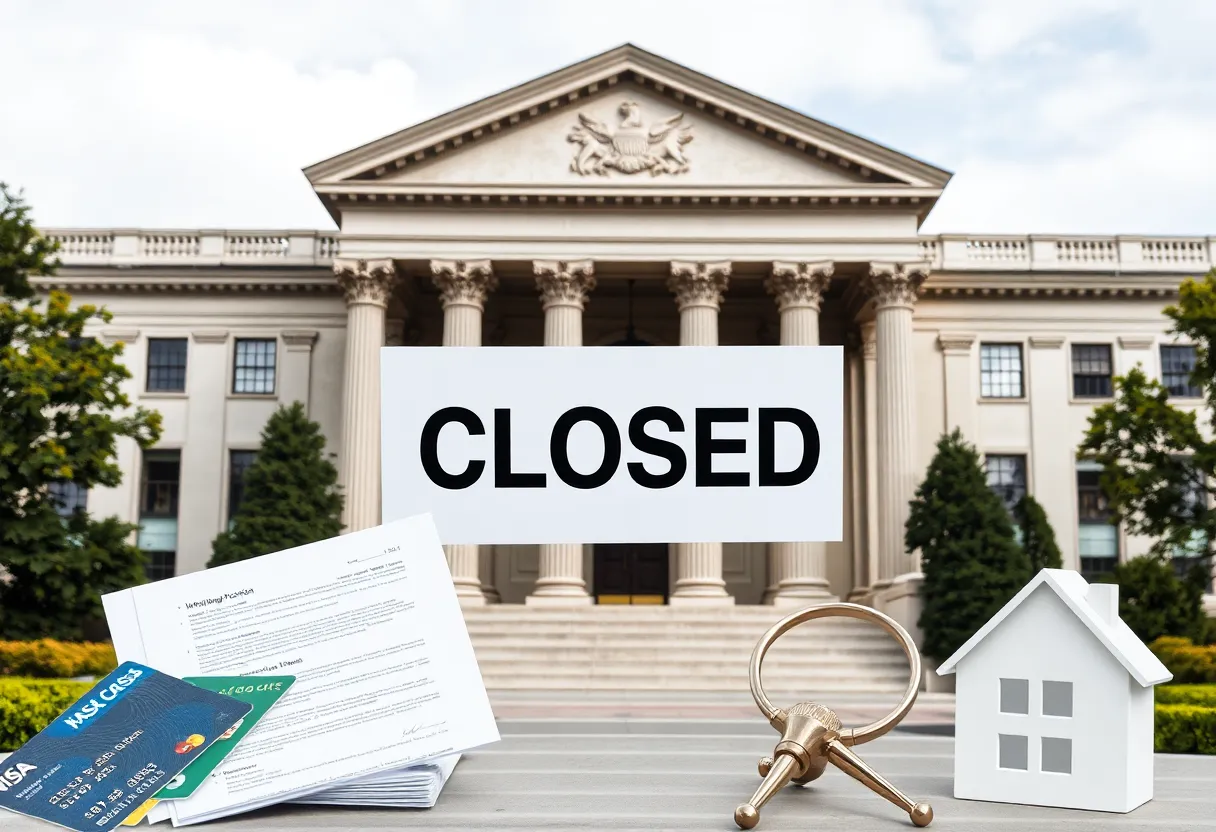

The Consumer Financial Protection Bureau has paused its operations under new leadership.

The Trump administration has frozen nearly all operations of the Consumer Financial Protection Bureau (CFPB), creating significant concerns among consumer advocates. With new leadership under Russell Vought, the CFPB’s activities, including rule-making and investigations, will be paused. The agency, known for returning over $21 billion to consumers, faces scrutiny amid accusations of political bias and operational redundancies. Concerns are growing over potential impacts on consumer protection and data privacy as political figures and industry experts voice alarm over the changes.

In a surprising move, the Trump administration has decided to put the brakes on nearly all operations of the Consumer Financial Protection Bureau (CFPB). This shift has raised eyebrows across the board as the CFPB has been a crucial player in protecting consumer rights since its inception back in 2011 following the 2008 financial meltdown.

Taking the reins at the CFPB is Russell Vought, who was recently appointed as the acting director. His first order of business? An email directed to CFPB employees mandated an immediate pause on issuing proposed or formal rules, investigations, and even stakeholder engagements. Talk about hitting the brakes hard!

Employees received the notice on a Saturday night, a time when most people are winding down from their week. From February 10, 2025, the CFPB’s headquarters will shut its doors for a week, with all staff working remotely unless instructed otherwise. This is a significant shift for an agency that plays a pivotal role in areas like mortgages, credit cards, and student loans.

It’s important to note that during its time in operation, the CFPB has successfully returned over $21 billion to consumers. This money often comes back as refunds and restitution for various consumer financial issues. So, the halting of its operations is not just a minor adjustment but something that could significantly impact many consumers out there.

Making matters even more intriguing, the CFPB has faced criticism from conservative circles almost since it was born. Accusations of overreach and alleged biased funding for liberal causes have made it a target for reform. The most recent directive further cements the belief that there’s a concerted effort to dilute the CFPB’s power, aligning with past efforts by the Trump administration to rein in federal agencies.

In a notable reaction to these developments, tech mogul Elon Musk commented on social media platforms hinting at his disapproval of the agency with a simple “CFPB RIP.” Meanwhile, the agency’s homepage mysteriously went dark, displaying a “page not found” error message. This only adds to the speculation surrounding what’s next for the CFPB and its future effectiveness.

As if declaring a halt on operations wasn’t enough, Vought also made it clear that the CFPB would not be withdrawing its upcoming round of funding from the Federal Reserve, arguing that its current reserves are excessive. This financial angle is especially relevant considering the agency has an annual budget of approximately $758 million and around 1,750 employees to support various consumer protection programs.

Concerns are also mounting over potential data privacy violations stemming from these decisions. The National Treasury Employees Union raised alarms about the possible implications of the suspension and the Department of Education’s access to CFPB systems. With these changes, many are left wondering how consumer data and privacy will be safeguarded going forward.

Political figures are already voicing their concerns about these drastic operational halts. Senator Elizabeth Warren expressed alarm, suggesting that this could leave consumers more vulnerable to scams and unfair practices by large corporations, a fear that resonates widely among consumer advocates.

In summary, the Trump administration’s decision to put the CFPB on hold is raising questions and worries for many. As the agency prepares to pause operations and adapt to new leadership, consumers and advocates will be watching closely to see what unfolds next.

News Summary The Myasthenia Gravis Foundation of America hosted a record-breaking national patient conference from…

News Summary The Trump administration's proposal to cut $700 million from CDC funding for HIV…

News Summary Chautauqua County has introduced the Family-Centered Case Management (FCCM) program aimed at supporting…

News Summary The Green Bay Packers have been awarded international marketing rights in Germany, Ireland,…

News Summary The Los Angeles Chargers are taking exciting steps to expand their brand in…

News Summary Nvidia is revolutionizing the advertising industry with advanced AI technology that enables brands…